2020 has been a “wild ride” to say the least and it’s not over! Our resilience during this particularly difficult year is a testament to the human spirit! If you’re a business owner, as I am, you may have different planning needs as we close out this very unusual year and plan for 2021.

Consider your tasks to close a summer home. You’ll need to pack away the beach toys. With no one occupying your vacation home during the winter, you’ll want to lock and shutter the windows. All of these are on your checklist of things to do, to make sure all the steps are completed to close the house for the season.

To closeout your business year, you’ll need to:

- Permanently file closed client accounts and securely store information for the required retention period. Remember to follow GDPR guidelines to secure clients’ private information.

- Closeout HSA & FSA medical spending plans and other plans that end annually.

- Check out our tax calculator, to get a tax payment estimation.

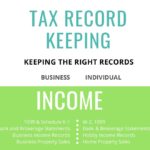

If you’re filing your 2020 taxes in December or March of 2021, use the checklist below to ensure you have all the documents to complete your 2020 closeout.

Don’t forget to document Direct Expenses and Indirect Expenses, Depreciation, and Improvements. As we have been working from home for most of this year, there may be additional expenses to consider that you didn’t consider in previous years? Contact us, we can tell you what those are.

Click and download the image below, gather the documents to file, and prepare them for your 2020 closeout.

Cheers!

JD Longino, CPA